Starting a business has always been a challenging yet rewarding endeavor. In today’s fast-paced, technology-driven world, the landscape for entrepreneurs has evolved significantly. While building a financially stable business as a beginner may seem daunting, it is entirely possible with the right strategies, resources, and mindset. Michael Shvartsman, a seasoned investor and owner of Rocket One Capital, reveals the key factors that can help new entrepreneurs achieve financial stability in their ventures.

1. Understanding the Market

One of the fundamental steps in building a financially stable business is understanding the market. Beginners must conduct thorough market research to identify demand, understand their target audience, and analyze competitors. This knowledge allows entrepreneurs to tailor their products or services to meet market needs effectively.

“Understanding your market is crucial,” says Michael Shvartsman. “It helps you identify opportunities and avoid potential pitfalls, giving you a solid foundation to build upon.”

2. Developing a Solid Business Plan

A well-thought-out business plan is essential for any new venture. It serves as a roadmap, outlining the business’s goals, strategies, financial projections, and operational plans. A robust business plan not only guides the entrepreneur but also attracts potential investors and lenders by demonstrating the viability and sustainability of the business.

“Investors look for a clear, detailed business plan,” notes Michael Shvartsman. “It shows that the entrepreneur has done their homework and is prepared to navigate the challenges ahead.”

3. Leveraging Technology

In today’s digital age, technology can be a powerful ally for new businesses. From automating processes to reaching a broader audience through digital marketing, leveraging technology can enhance efficiency and reduce costs. Utilizing tools can help beginners scale their businesses more effectively, such tools as:

- e-commerce platforms,

- social media,

- customer relationship management (CRM) software.

“Technology levels the playing field for new entrepreneurs,” explains Michael Shvartsman. “It provides them with the tools to compete with larger, more established companies.”

4. Managing Finances Wisely

Financial management is a critical component of business stability. Beginners should focus on maintaining a healthy cash flow, keeping expenses in check, and planning for contingencies. Using accounting software and consulting with financial experts can help new business owners make informed decisions and stay on top of their financial health.

“Good financial management practices are the backbone of any successful business,” says Michael Shvartsman. “They help you stay agile and prepared for any financial challenges that come your way.”

5. Building a Strong Network

Networking is invaluable for new entrepreneurs. Building relationships with other business owners, mentors, and industry professionals can provide support, advice, and opportunities for collaboration. Attending industry events, joining local business groups, and engaging in online communities can help beginners expand their network and gain valuable insights.

“Networking opens doors,” asserts Michael Shvartsman. “It connects you with people who can offer guidance, resources, and opportunities that you might not find on your own.”

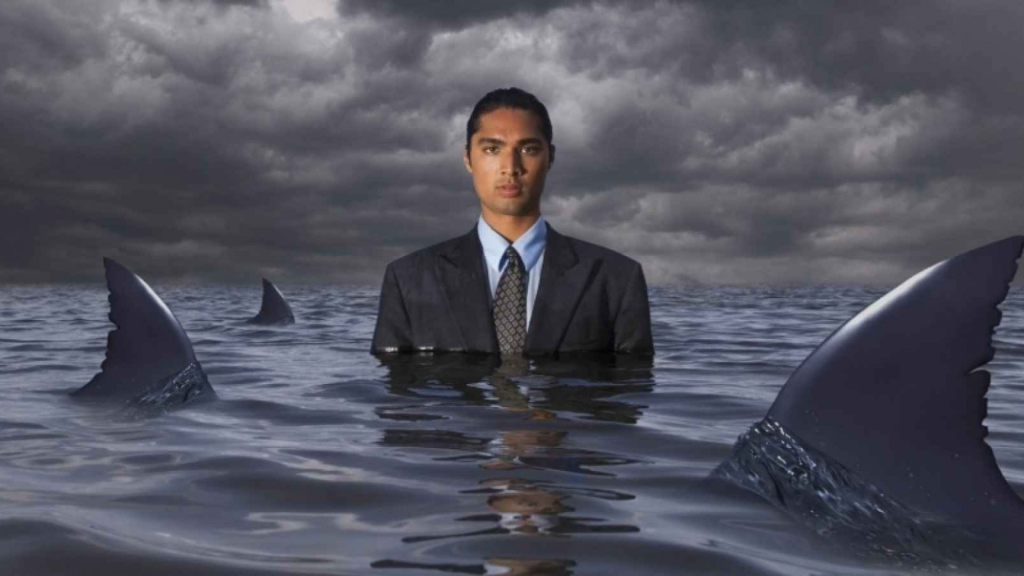

6. Securing Funding

Access to capital is often a major hurdle for new businesses. However, there are numerous funding options available today, from traditional bank loans to venture capital, crowdfunding, and angel investors. Understanding the pros and cons of each option and preparing a compelling pitch can help entrepreneurs secure the necessary funding to launch and grow their business.

“Don’t be afraid to explore different funding avenues,” advises Michael Shvartsman. “Each has its own benefits, and the right one for your business depends on your specific needs and goals.”

7. Staying Adaptable and Resilient

The ability to adapt to changing circumstances and recover from setbacks is crucial for any entrepreneur. The business landscape is constantly evolving, and new challenges can arise unexpectedly. Cultivating resilience and being open to pivoting when necessary can help beginners navigate these challenges and maintain financial stability.

Building a financially stable business as a beginner in today’s world is challenging but entirely achievable. By understanding the market, developing a solid business plan, leveraging technology, managing finances wisely, building a strong network, securing funding, and staying adaptable, new entrepreneurs can set themselves up for success. With determination and the right strategies, financial stability is well within reach for those willing to put in the effort and learn from their experiences.